The Florida Hometown Heroes Housing Program is a groundbreaking initiative that has been making a real difference in the lives of our heroic service members, frontline heroes and their families. The program has been providing much-needed housing assistance to those who have served our country with honor and distinction since its establishment in 2015.

The Florida Hometown Heroes Housing Program makes homeownership affordable for eligible frontline community workers such as law enforcement officers, firefighters, educators, healthcare professionals, childcare employees, and active military or veterans.

The Florida Hometown Heroes Housing Program provides an invaluable opportunity for these individuals to become homeowners without the financial burden that often accompanies such a dream. With the help of loan officers and access to Fannie Mae and Freddie Mac loans, first responders, military personnel, and all other hometown heroes have access to affordable housing options that fit within their budget.

This program provides down payment and closing cost assistance to first-time, income-qualified homebuyers so they can purchase a primary residence in the community in which they work and serve. The Florida Hometown Heroes Loan Program also offers a lower first mortgage rate and additional special benefits to those who have served and continue to serve their country.

If you think you meet these requirements, please click here to connect with a loan officer in your area and get started.

The Florida Hometown Heroes Housing Program is designed to provide first and second mortgage loans, closing cost assistance, and down payment assistance for eligible hometown heroes:

- Eligible frontline workers can receive lower than market rates on an FHA, VA, RD, Fannie Mae or Freddie Mac first mortgage, reduced upfront fees, no origination points or discount points and down payment and closing cost assistance.

- Borrowers can receive up to 5% of the first mortgage loan amount (maximum of $25,000) in down payment and closing cost assistance.

- Down payment and closing cost assistance is available in the form of a 0%, non-amortizing, 30-year deferred second mortgage. This second mortgage becomes due and payable, in full, upon sale of the property, refinancing of the first mortgage, transfer of deed or if the homeowner no longer occupies the property as his/her primary residence. The Florida Hometown Heroes loan is not forgivable.

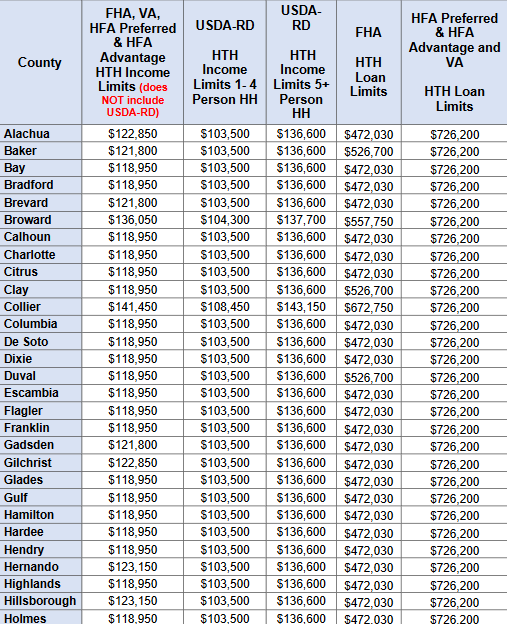

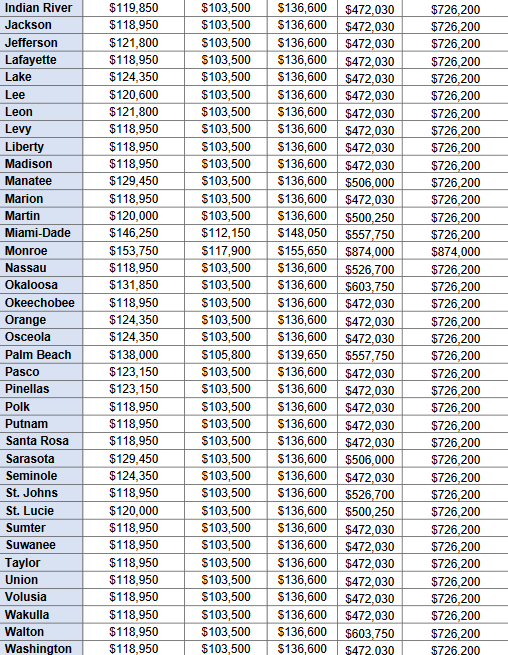

FL Hometown Heroes Loan Limits

Hometown Heroes Program Video

Second Mortgage Options

Moving forward, there are a few second mortgage options that may be beneficial for first-time homebuyers. These include:

- Home Equity Line of Credit (HELOC)

- Piggyback Loans

- Interest-Only Loans

A HELOC is a line of credit that allows homeowners to borrow against the equity in their home at an adjustable rate depending on market conditions. This type of loan can be used for financing large projects such as renovations or repairs, and it offers flexible repayment terms. It’s important to note that interest rates tend to be higher than traditional mortgages and the amount you can borrow is based on your equity in the home.

Piggyback loans are another option for those looking to finance their first home purchase without putting down a large down payment. A piggyback loan includes two separate mortgages, with one covering 80% of the purchase price and the other covering 10-20%. The secondary loan is typically taken out at a higher rate than the primary loan, but it can help buyers avoid paying private mortgage insurance (PMI). Lastly, an interest-only loan allows borrowers to make payments only on the interest accrued during each month, which reduces monthly payments significantly and can help buyers qualify for more expensive homes. However, since no principal is paid back during this time, this type of loan should be used cautiously by those who understand its risks.

Second mortgage options provide an alternate way for first-time homebuyers to finance their purchase without having to put down a large down payment upfront. Depending on your financial situation, it may make sense to consider one of these options if you need additional funds or want more flexibility when it comes to repayment terms and rates. Ultimately, taking time to research your different options will ensure you find the best fit for your needs and budget.

Homebuyer Credit Score Criteria

At Florida Hometown Heroes Housing Program, we understand that not all homebuyers have the same credit score. That’s why we offer a range of options to meet your individual situation. Whether you have excellent credit or no credit at all, we can help you find a loan program that meets your needs.

We specialize in helping those with lower credit scores and work hard to get them approved for a loan. Our loan officers are experienced in working with borrowers who don’t have perfect credit and can provide customized advice based on their specific situation. We offer a variety of products, including FHA loans and VA mortgages, to help those with less than perfect credit secure financing for their new home.

We understand that buying a home is an important decision and we’re here to make sure you get the best possible deal for your situation. We’ll work with you every step of the way to ensure you get the right mortgage for you and your family.

Primary Residence Requirements

The Florida Hometown Heroes Housing Program has been a beacon of hope for many veterans and their families, providing affordable housing options that make home ownership a reality. But do you qualify for the program? Let’s explore the primary residence requirements for this important initiative.

First, any applicant must have lived in the state of Florida for at least one year prior to filing an application. This is to ensure that those receiving aid from the program are invested in building a life in their new home state. Additionally, applicants must intend to make their primary residence the property they are applying to own or rent through the program. The property must also be used exclusively as a primary residence, with no other use allowed.

Ultimately, it is important to remember that this program is designed to provide housing stability and security for veterans and their families who have served our country with honor and bravery. As such, applicants should be aware of these minimum requirements before taking advantage of this opportunity.

First Mortgage Loan Programs

The Florida Hometown Heroes Housing Program has a variety of first mortgage loan programs available to qualified veterans, National Guard members and active duty military personnel. Our goal is to help service members and their families access the home ownership opportunities they deserve.

Our range of loan options includes VA loans with competitive interest rates and no down payment required, FHA loans with low down payments and flexible credit guidelines, and USDA Rural Development loans for those living in rural areas. We also offer conventional loans for those who qualify, as well as refinancing options for current homeowners.

We understand that finding the right loan program can be a challenge; that’s why we offer personal guidance from experienced professionals to help you make informed decisions about your housing needs. With our expert advice, you can find the loan option that best fits your budget, lifestyle and financial goals.

FHA, Fannie Mae, And Freddie Mac Loans

The Florida Homebuying Program is just the beginning of your journey to homeownership. There are other loan options available to you, such as FHA, Fannie Mae, and Freddie Mac loans.

FHA (Federal Housing Administration) loans are backed by the federal government and have low downpayment requirements, making them ideal for first time homebuyers. Fannie Mae and Freddie Mac loans are both government-sponsored enterprises that assist in making mortgages more accessible to those with less traditional credit histories or lower incomes.

Here is a quick summary of the three loan types:

*FHA Loans: Low downpayment requirements and backed by the federal government

*Fannie Mae Loans: Government-sponsored enterprise that helps people with nontraditional credit histories or lower incomes get access to mortgages

*Freddie Mac Loans: Government-sponsored enterprise that helps people with nontraditional credit histories or lower incomes get access to mortgages

The Florida Homebuying Program has made it easier than ever before for Floridians to become homeowners. With these loan options, every Floridian has an opportunity to purchase their dream home. So don’t delay – contact your local housing finance agency today to learn more about what loan option may be best for you!

Resources: